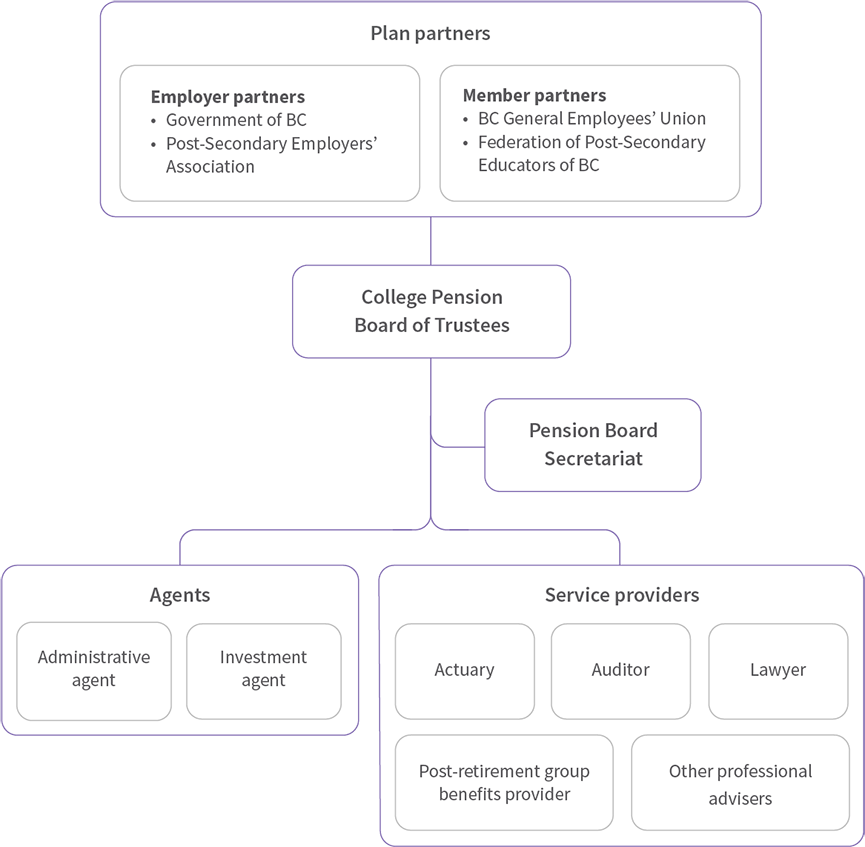

Organizational structure of the plan

Learn how BC's College Pension Plan is structured and organized.

The College Pension Plan provides secure retirement income for about 36,000 plan members, including employees and senior administrators at 24 public post-secondary institutions across the province. As of August 31, 2023, there are:

- 17,249 active members (working and contributing to the plan)

- 10,662 retired members (receiving a pension)

- 8,198 inactive members (no longer working for a plan employer but have left their contributions with the plan and may be eligible for a pension)

The above numbers include limited members (former spouses who are entitled to a portion of a member's pension).

As of August 31, 2023, the plan had investment assets of about $7.2 billion.

The College Pension Board of Trustees is responsible for plan governance. Trustees are nominated and appointed by the four plan partners – the British Columbia General Employees' Union (BCGEU), the Federation of Post-Secondary Educators of BC (FPSE), the Post-Secondary Employers' Association (PSEA) and the provincial government.

The College Pension Plan Joint Trust Agreement sets out how the 10 trustees are appointed:

- The provincial government appoints four trustees (one nominated by PSEA)

- FPSE appoints three trustees

- BCGEU appoints one trustee

- The plan member partners appoint one trustee who must be retired and receiving a pension from the plan

- The plan employer partners appoint one trustee who must be an active member of the plan and not a member of either BCGEU or FPSE

Trustees are responsible for governing the plan and managing the pension fund, which includes pension plan administration and investment of assets. They do this by making decisions and providing direction to:

- British Columbia Pension Corporation (the plan's administrative agent) on administration of the plan, including services to members

- British Columbia Investment Management Corporation (the plan's investment agent) on management of the plan's assets

The following service providers also play an important role:

- Eckler Ltd. serves as the plan’s independent actuary. Eckler conducts an actuarial valuation on the plan’s funding every three years and supports the board in its decision making as appropriate.

- Green Shield Canada provides retired plan members access to voluntary group extended health care and dental coverage.

- Lawson Lundell LLP is the plan’s legal counsel.

- KPMG LLP provides external audit services to the plan. Pension board secretariat provides day-to-day professional and operational support to help the board meet its governance and fiduciary obligations.

- WTW is the plan’s benefits advisor.

Organizational structure

Related content for organizational structure of the plan

British Columbia Pension Corporation

British Columbia Investment Management Corporation